The Cryptocurrency crash market is known for its extreme volatility, but when prices crash suddenly, investors are left searching for answers. A cryptocurrency crash can wipe out billions of dollars in market value, shake investor confidence, and impact global financial markets.

But what exactly causes these sudden drops? Is it just market cycles, or are there deeper reasons behind the decline? In this article, we’ll explore the key factors behind cryptocurrency crashes, analyze historical downturns, and provide insights on what investors can do during such times.

Key Takeaways

- Cryptocurrency crash are driven by multiple factors, including speculation, regulations, and macroeconomic trends.

- Panic selling and whale manipulation can accelerate price drops.

- Global financial trends and interest rate hikes significantly impact crypto markets.

- Past Cryptocurrency crash show that recovery is possible, but some projects never recover.

- Investors should focus on risk management, diversify their portfolios, and avoid emotional decisions during a crash.

Major Causes of a Cryptocurrency Crash

Market Speculation and Investor Panic

Cryptocurrency crash are highly speculative assets, meaning their prices often rise and fall based on hype, media coverage, and investor sentiment. When panic sets in, mass selling occurs, causing a domino effect that leads to a market crash.

- Fear, uncertainty, and doubt (FUD) spread rapidly through social media and news outlets.

- Panic selling causes a chain reaction, leading to further price declines.

- High volatility results in large price swings within minutes or hours.

Regulatory Crackdowns and Government Actions

Governments worldwide have a significant impact on cryptocurrency prices. Any negative news regarding bans, restrictions, or strict regulations can cause a massive sell-off.

- China’s cryptocurrency mining and trading ban in 2021 led to a major market crash.

- The U.S. SEC’s lawsuits against major crypto exchanges have caused market uncertainty.

- New tax laws on digital assets can discourage investments.

When governments tighten their grip on cryptocurrencies, investors become uncertain about the future, leading to panic selling.

Macroeconomic Factors and Interest Rate Hikes

Cryptocurrency crash is not isolated from global financial trends. Economic downturns, inflation, and interest rate hikes can heavily impact digital assets.

- Rising interest rates make traditional investments (bonds, savings accounts) more attractive, leading investors to withdraw funds from risky assets like crypto.

- High inflation reduces purchasing power, making people less likely to invest in speculative assets.

- Economic recessions or geopolitical conflicts create financial instability, causing investors to pull out of volatile markets.

When global markets struggle, Cryptocurrency crash often take a hit as investors look for safer assets.

Exchange Collapses and Security Breaches

Cryptocurrency exchanges play a crucial role in the market, but when they collapse, it shakes investor confidence.

- The FTX collapse in 2022 triggered a major market crash, as billions in investor funds were lost.

- Mt. Gox’s bankruptcy in 2014 led to a long-lasting bear market.

- Large-scale hacks and security breaches (such as the Ronin Network hack) can result in massive losses, leading to a market sell-off.

When investors fear losing access to their funds, they withdraw assets from exchanges, leading to further price declines.

Whale Manipulation and Market Liquidations

Cryptocurrency crash markets are often influenced by whales—investors who hold large amounts of a particular cryptocurrency. Their actions can lead to price manipulation.

- Whales may dump large amounts of crypto, causing sudden price drops.

- Large-scale liquidations (when leveraged traders are forced to sell) can accelerate a crash.

- Flash crashes occur when high-frequency trading bots trigger massive sell-offs.

Market manipulation by large players can create artificial volatility, leading to unpredictable price swings.

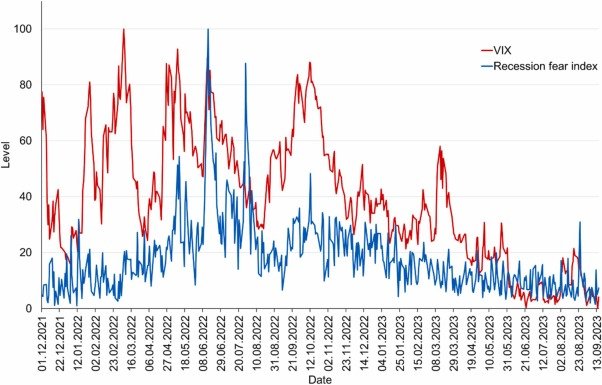

Fear of Recession and Stock Market Correlation

While cryptocurrencies were initially believed to be independent of traditional markets, they are now heavily correlated with stocks and global financial trends.

- When the stock market crashes, cryptocurrency often follows.

- Investors move their money to safer assets like gold and bonds during economic downturns.

- The fear of a global recession causes capital to exit speculative markets, including crypto.

This connection means that bad news in traditional markets can directly impact cryptocurrency prices.

Over-Leveraging and Liquidations

Many traders use leverage (borrowed funds) to trade cryptocurrencies. While leverage can amplify gains, it can also cause massive losses.

- If the market moves against highly leveraged traders, their positions get liquidated, leading to more sell-offs.

- Large-scale liquidations act as a cascading effect, pushing prices lower.

- Margin calls force investors to sell assets at a loss, accelerating the crash.

This factor is often responsible for the severity of crypto market crashes.

Historical Cryptocurrency Crashes

Bitcoin’s 2018 Crash

- Bitcoin reached $20,000 in late 2017 before crashing to around $3,000 by the end of 2018.

- The crash was triggered by ICO bubbles bursting and regulatory crackdowns.

COVID-19 Market Crash (March 2020)

- Bitcoin and altcoins lost nearly 50% of their value within a few days due to global market panic.

- Investors sold off risky assets in response to economic uncertainty.

2021-2022 Crypto Crash

- The market fell from a $3 trillion valuation to under $1 trillion.

- Causes included China’s crypto ban, interest rate hikes, and the Terra (LUNA) collapse.

These historical crashes show that multiple factors contribute to market downturns, often happening unexpectedly.

How to Navigate a Cryptocurrency Crash

While crypto crashes can be painful, there are strategies to minimize risks and potentially benefit from market downturns.

Stay Calm and Avoid Panic Selling

Making emotional decisions often leads to greater losses. It’s essential to take a rational approach and assess the situation before making any moves.

Diversify Your Portfolio

Investing in a mix of assets—including stocks, bonds, and cryptocurrencies—can reduce risk.

Use Stop-Loss Orders

Setting a stop-loss order can help limit losses by automatically selling an asset when it reaches a certain price.

Keep an Eye on Market Trends and News

Staying informed about regulatory changes, economic conditions, and industry developments can help you make better investment decisions.

Consider Dollar-Cost Averaging (DCA)

Rather than investing a lump sum, consider spreading out your purchases over time to reduce the impact of volatility.

Avoid High Leverage

Trading with leverage increases the risk of liquidation and should be avoided, especially during volatile market conditions.

How to Protect Yourself During a Cryptocurrency Crash

- Diversify Your Investments: Don’t put all your money into crypto. Consider traditional assets like stocks and bonds.

- Use Stop-Loss Orders: This prevents heavy losses by automatically selling when prices fall to a certain level.

- Avoid Leverage Trading: High leverage can lead to liquidation and massive losses.

- HODL (Hold On for Dear Life): If you believe in crypto’s long-term potential, holding through crashes may be a strategy.

- Stay Updated: Follow reliable crypto news sources to avoid panic decisions.

Cryptocurrency Crash: Market in Turmoil

The cryptocurrency market has always been known for its extreme volatility, but sudden crashes can shake even the most experienced investors. Over the years, we’ve seen multiple downturns where billions of dollars in market value vanished in just a few days. The recent cryptocurrency crash has sent shockwaves through the industry, leaving investors questioning the future of digital assets.

In this article, we will explore the key reasons behind the cryptocurrency market turmoil, analyze historical crashes, and discuss what investors can do to navigate these challenging times.

Reasons Behind the Cryptocurrency Crash

Investor Panic and Market Speculation

The crypto market is highly speculative, meaning prices can be driven by hype and FOMO (fear of missing out) but also drop rapidly when fear sets in.

- Mass Panic Selling: When prices start to fall, many investors panic and sell, causing further declines.

- Social Media Influence: Negative news spreads quickly through social media, causing fear and uncertainty.

- Crypto “Whales” Manipulation: Large investors holding significant amounts of cryptocurrency can manipulate prices by selling or buying in large volumes.

Over-Leveraging and Liquidations

Many traders use leverage (borrowed money) to increase their potential profits, but this strategy can backfire during a crash.

- Mass Liquidations: If prices drop suddenly, leveraged traders are forced to sell their assets, pushing prices even lower.

- Cascading Effect: One liquidation leads to another, creating a chain reaction that accelerates the crash.

- Volatility Spikes: High leverage amplifies market movements, making price swings even more extreme.

Also Read: How To Start Cryptocurrency Investment As A Beginner?

Conclusion

Cryptocurrency crashes are a natural part of the market cycle. While they can be frightening, understanding the causes—such as investor panic, regulatory crackdowns, and macroeconomic conditions—can help investors make informed decisions.

By diversifying portfolios, avoiding leverage, and staying updated with market trends, investors can navigate these downturns more effectively. Despite short-term crashes, the long-term potential of blockchain and cryptocurrency remains strong.

FAQs

What causes a cryptocurrency crash?

A crypto crash can be caused by market speculation, regulatory crackdowns, macroeconomic factors, exchange collapses, and large-scale liquidations.

How long do cryptocurrency crashes last?

It depends on the cause. Some crashes recover within weeks, while others (like the 2018 crash) took over a year to rebound.

Should I sell during a crypto crash?

Selling during a crash depends on your investment strategy. If you believe in long-term growth, holding may be better. Otherwise, setting stop-loss orders can limit losses.

Can cryptocurrency recover after a crash?

Yes. Bitcoin and major altcoins have historically recovered after crashes, although some projects may never bounce back.

How does leverage impact crypto crashes?

Leverage amplifies both gains and losses. When highly leveraged positions are liquidated, it triggers mass sell-offs, deepening the crash.

Is cryptocurrency a safe investment?

Crypto is highly volatile and considered a high-risk investment. Proper risk management is essential.

How do regulations affect the crypto market?

Government regulations can cause panic and market instability, but in the long run, clear regulations can bring legitimacy to the industry.