Cryptocurrency risks has revolutionized the financial world, offering new opportunities for investment, decentralized transactions, and financial independence. However, alongside the potential rewards, investing in cryptocurrencies comes with significant risks. Understanding these risks is crucial for making informed investment decisions and protecting your assets.

In this article, we will explore the biggest cryptocurrency risks that investors should be aware of, how to mitigate them, and whether crypto is a safe investment in the long run.

Key Takeaways

Cryptocurrency is volatile, and prices can crash suddenly.

Security risks, hacks, and scams are common—always secure your assets.

Regulatory changes can affect your ability to trade and invest.

Losing private keys means losing your funds forever.

Emotional trading leads to bad investment decisions.

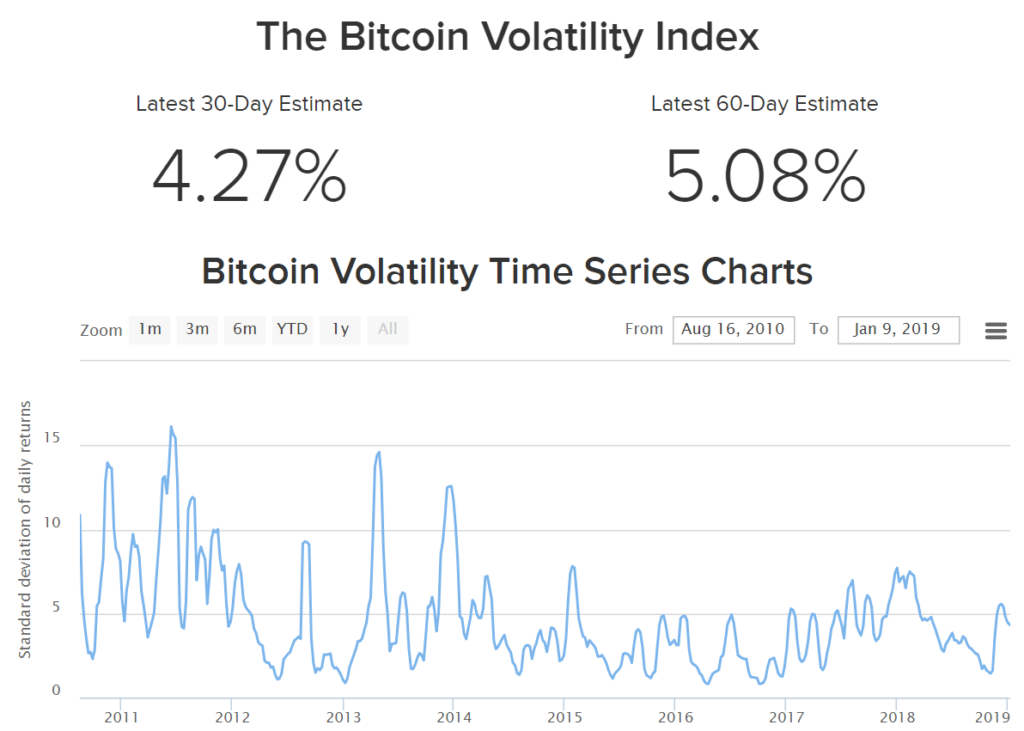

Market Volatility – The Biggest Cryptocurrency Risks

Cryptocurrency markets are highly volatile, with prices fluctuating dramatically within minutes. This is due to several factors, including:

- Speculative trading – Many investors buy and sell based on hype rather than real value.

- Market sentiment – Positive or negative news can cause sudden price swings.

- Low liquidity – Unlike traditional markets, cryptocurrency markets can be illiquid, leading to price manipulation.

Example:

- Bitcoin’s price cryptocurrency risks dropped from $68,000 in November 2021 to $16,000 in late 2022, wiping out billions in investor funds.

How to Mitigate This Risk?

- Invest only what you can afford to lose.

- Use dollar-cost averaging (DCA) to reduce the impact of volatility.

- Diversify your portfolio with stable assets.

Security Risks – Hacking and Scams

Because cryptocurrency risks are digital, they are vulnerable to security breaches. Hackers target exchanges, wallets, and investors through various attacks.

Common Security Risks:

- Exchange Hacks – Many exchanges have been hacked, resulting in stolen funds.

- Wallet Hacks – If a hacker gets access to your private key, your funds are gone forever.

- Phishing Scams – Fake websites and emails trick users into revealing their login credentials.

Example:

- In 2014, Mt. Gox, a major Bitcoin exchange, was hacked, losing 850,000 BTC worth $450 million at the time.

How to Mitigate This Risk?

- Use hardware wallets for long-term storage.

- Enable two-factor authentication (2FA) on all accounts.

- Never share your private keys or recovery phrases.

Regulatory and Legal Risks

cryptocurrency risks regulations vary across countries, and governments can impose strict rules or outright bans. Changes in regulations can impact crypto adoption, trading, and taxation.

Key Regulatory Risks:

- Governments may ban or restrict crypto trading (e.g., China’s crypto ban).

- Tax laws on crypto gains can be complex and vary by region.

- Some exchanges may be forced to shut down or restrict services due to regulatory issues.

Example:

- In 2021, China banned all cryptocurrency transactions, causing Bitcoin’s price to drop.

How to Mitigate This Risk?

- Stay informed about cryptocurrency risks in your country.

- Use regulated exchanges that comply with local laws.

- Keep detailed records of your crypto transactions for tax reporting.

Scams and Fraud – Avoiding Crypto Scams

The cryptocurrency risks industry is full of scams that trick investors into losing their money. Knowing how to spot scams can help you avoid losing your investments.

Common Crypto Scams:

- Ponzi Schemes – Fake projects that promise high returns but collapse when new investors stop joining.

- Rug Pulls – Developers abandon a project after raising funds, leaving investors with worthless tokens.

- Fake Airdrops – Scammers trick users into giving away personal information in exchange for free tokens.

Example:

- The OneCoin Ponzi scheme scammed investors out of $4 billion, promising guaranteed profits.

How to Mitigate This Risk?

- Research any project before investing. Avoid unrealistic promises.

- Use trusted exchanges and official project websites.

- If it sounds too good to be true, it probably is!

Loss of Private Keys – Irrecoverable Loss

Unlike traditional banking, cryptocurrency risks require users to securely store their private keys. Losing access to your private key means losing your funds forever.

Example:

- A man in the UK accidentally threw away a hard drive containing 7,500 BTC, worth over $500 million today.

How to Mitigate This Cryptocurrency Risks ?

- Store private keys in a secure, offline location.

- Use hardware wallets or multi-signature wallets for added security.

- Keep multiple secure backups of your recovery phrase.

Liquidity Risks – Difficulty in Selling Assets

Some cryptocurrencies have low trading volume, making it difficult to sell them quickly without affecting the price. This is especially risky for low-cap altcoins.

Example:

- Investors in small-cap tokens often find they cannot sell their holdings without driving the price down significantly.

How to Mitigate This Risk?

- Invest in well-established cryptocurrencies with high liquidity.

- Check a coin’s 24-hour trading volume before investing.

- Avoid investing in new or unknown projects with low market activity.

Smart Contract Bugs and DeFi Risks

Decentralized Finance (DeFi) cryptocurrency risks platforms use smart contracts to automate financial transactions. However, bugs and vulnerabilities can lead to massive losses.

Example:

- In 2022, hackers stole $625 million from the Ronin Network, exploiting a DeFi protocol vulnerability.

How to Mitigate This Risk?

- Only use audited and well-established DeFi platforms.

- Be cautious with yield farming and high APY offers.

- Don’t invest all your funds in DeFi projects with unknown teams.

Environmental Concerns – Energy-Intensive Mining

Proof-of-Work (PoW) cryptocurrency risks like Bitcoin require massive amounts of energy to mine. This has led to concerns about environmental sustainability.

Example:

- Bitcoin mining consumes more electricity than some entire countries, such as Argentina.

How to Mitigate This Risk?

- Consider investing in eco-friendly cryptocurrencies like Ethereum (now using Proof-of-Stake).

- Support projects using renewable energy for mining.

Psychological Risks – Emotional Trading

Many investors panic sell when prices drop and FOMO (fear of missing out) into bad investments. This leads to poor financial decisions.

How to Mitigate This Risk?

- Have a clear investment strategy and stick to it.

- Avoid impulse buying and panic selling.

- Use stop-loss and take-profit orders to manage risk.

Also Read: Which Cryptocurrency Types Are Best For Investment?

Conclusion

Cryptocurrency risks presents both exciting opportunities and significant risks for investors. While it offers high potential returns, it is also subject to extreme market volatility, security threats, scams, and regulatory uncertainty. To navigate these risks successfully, investors must stay informed, use secure storage methods, diversify their portfolios, and avoid emotional trading. While crypto remains a promising asset class, it is not suitable for everyone, especially those unwilling to tolerate high risk.

Ultimately, whether cryptocurrency is a good investment depends on your risk tolerance, investment strategy, and ability to research projects thoroughly. By understanding the risks involved and taking proper precautions.

FAQs

Is investing in cryptocurrency risks?

Yes, cryptocurrency risks are highly volatile and come with risks like hacks, scams, and regulatory uncertainty.

Can I lose all my money in crypto?

Yes, if you invest carelessly, lose your private keys, or fall victim to scams.

How can I protect my crypto assets?

Use secure wallets, enable two-factor authentication, and store private keys safely.

Are stablecoins safe?

Stablecoins are less volatile but can still be cryptocurrency risks if the issuer lacks transparency or liquidity.

Is crypto regulation a good thing?

Regulation can increase security and investor protection but may also limit innovation.

How do I spot a crypto scam?

Avoid projects promising guaranteed returns, vague whitepapers, or anonymous teams.

Should I invest in crypto for the long term?

Long-term investing can be profitable, but only in reliable projects with strong fundamentals.